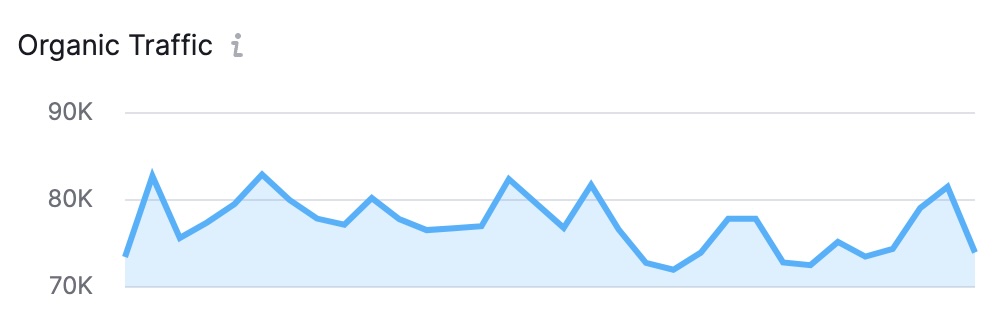

Xcite have provided consistent value and growth for Loans2Go year on year, producing multiple websites and making sure they appear in top ranking positions across organic SEO, achieving page 1 for major keywords including Loans, and online loans, generating over 70,000 results per month.

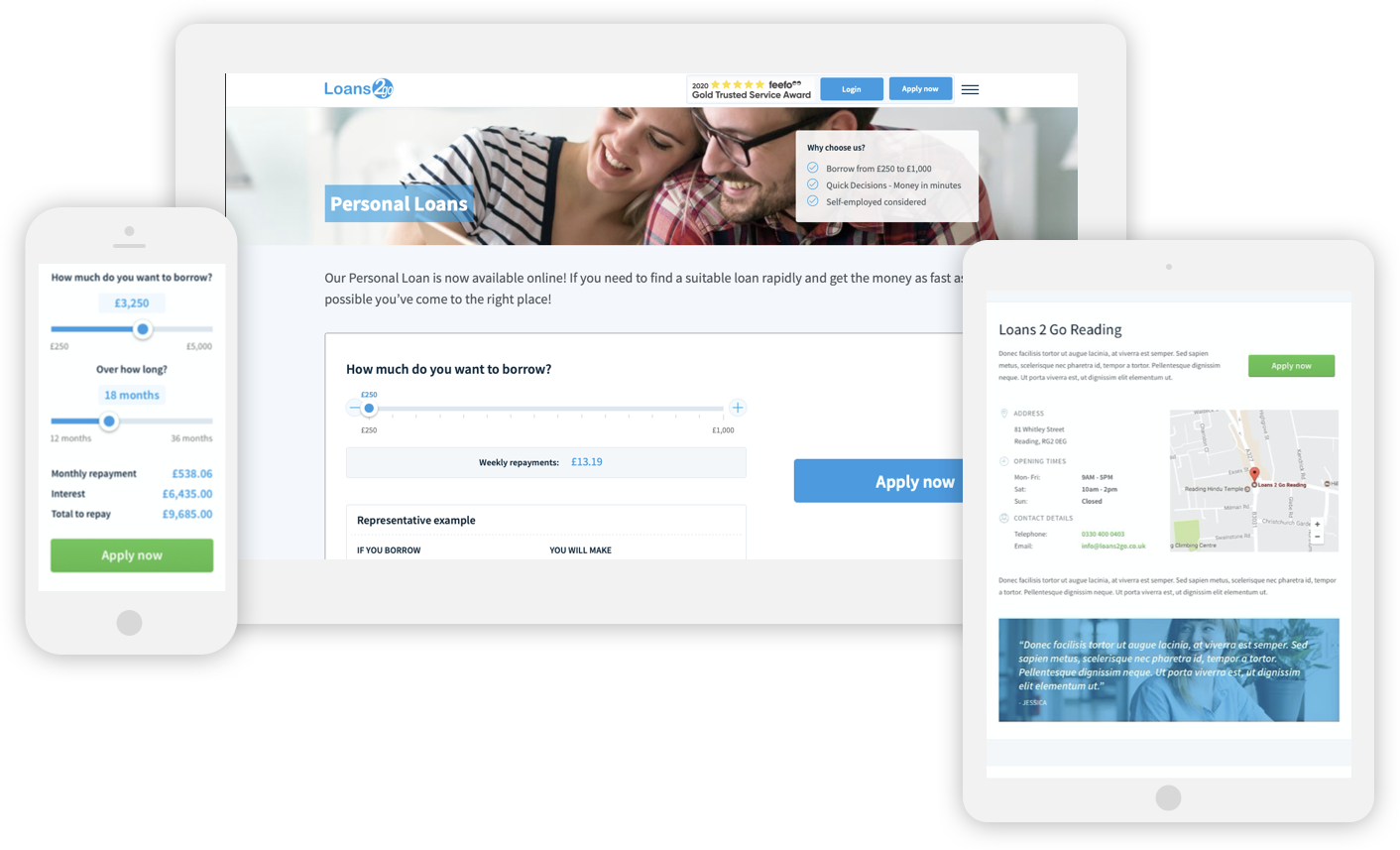

Conversion rates were significantly improved by analysing the user flow of the website and making the elements appear at the right stage such as loan calculators and online forms that were easier to use. Everything was funnelled into the application form which was tracked back to conversion results so we could see how user flow was performing. This then fed into the PPC and SEO conversion results where we saw an improvement from £35 CPA to £9 CPA.